Written by Shaina Carlebach

Written by Shaina Carlebach

In which direction is the lending industry going?

Turbulent world events have impacted our lives, and many industries are now being forced to navigate unknown territory.

Although the lending industry will always be a vital component in our lives, it too has been greatly affected by high interest rates and lenders will need to implement new processes to continue to thrive.

Loans will always be a necessity for investors and small businesses. They accelerate business expansion and provide the fuel necessary for total money supply and fostering competition.

With the exorbitant costs of living, there is a major boom in personal loans to stay afloat and not drown in consolidated debts.

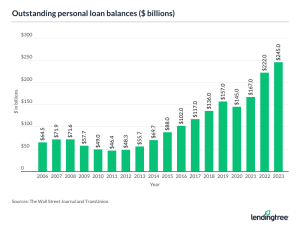

According to the latest industry data, Americans owe $245 billion in personal loan debt as of the first quarter of 2023, rising from $221 billion a year earlier. That is a 10.4 % jump from the previous year.

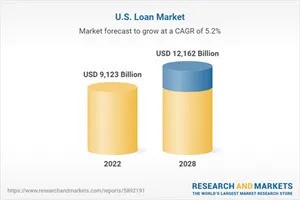

The United States Loan Market is anticipated to reach a value of $12.162 billion by 2028 from $9.123 billion in 2022, growing at a CAGR of 5.2%

How can lenders tap into this imminent potential for growth and stay ahead of the game?

The lending landscape has changed drastically in the past few years. The entrance of fintech companies and private lenders has opened the doors to individuals and companies with a low credit score. It is now possible for small businesses, the underbanked and the non-banked individuals to receive loans, yet at high interest rates to cover the risks involved of not recovering the loans.

In 2024, banks will continue to tighten their restrictive credit lending policies due to regulatory practices that will come into play according to Deloitte. This will only amplify the dire need for loans.

The lending market is on the rise and in this increasingly crowded space, fintech companies, private lenders and even banks will need to re-strategize and lower their interest rates to succeed in this highly competitive space.

Automating processes and offering online loans are critical for the survival of any lenders in this era of digital transformation.

Uncovering the Achilles’ Heel: Fraud and Risk in the Money Lending Industry

Yet, providing loans online, especially to those with low credit, goes hand in hand with the threat of human fraud. ID verification solutions, closely related to AML and KYC procedures are an integral part of any digital loan offering.

In today’s online market, it’s critical to detect a fraudster as early as possible in the relationship as identities and patterns are being created. Unfortunately, few lenders and banks opening relationships and doing business with customers via the internet have good tools, processes, and procedures to ensure the identity of customers.

Although digital and biometric identity verification tools have become increasingly popular in the market to verify customer identity and prevent human fraud, they are fraught with many challenges:

1) The feature of face recognition built into the identity verification system fringes on the privacy rights of the individual.

2) Photoshop and deepfake software can create realistic photos forging people’s appearances thus making them inadequate to compare with id certificates.

3) Poor sensory devices are not equipped to read a person’s fingerprints.

4) Uploading id documentation that is not readable can be frustrating and create a negative customer experience.

The cumulative losses from accelerating fraud and the high interest rates, imperative to charge to cover the risks of not recovering the loans, could end up deterring those with low credit to take loans at the onset resulting in high customer churn and major drop in profit gain.

To continue to thrive by offering trustworthy online financing solutions for borrowers, lenders need to apply a robust human fraud protection solution that will provide a better understanding of the authenticity of account users thus mitigating the risk of human fraud and enabling lower interest rates.

Ultimately, embedding an accurate expert solution detecting human authenticity could easily differentiate a lending platform from its competitors and cultivate a trustworthy reputation amid federal government signals towards greater regulatory scrutiny.